Depreciation percentage calculator

A list of commonly used depreciation rates is given in a. For instance the depreciation rate of a 50 water heater is 10.

Straight Line Depreciation Formula And Calculation Excel Template

Total amount of depreciation of an asset cannot exceed its a Depreciable value b Scrap value c Market value d None of these.

. Loan interest taxes fees fuel maintenance and repairs into. You can use low medium or high depreciation rates or enter a custom first 3 year depreciation percentage. So your annual percentage yield is 51162 which is the effective annual yield on your investment.

Sum of Years Depreciation Calculator. Where the cost is more than 300 then the depreciation formula must be used to calculate the percentage tax deductible amount. Ad Need an Easy Accurate Way to Comply with State Depreciation Across Multiple States.

Armed with that knowledge one way to compare the choice between new and used based on the combined yearly. Calculate the cost of owning a car new or used vehicle over the next 5 years. A P 1 - R100 n.

Find Depreciation For Your Car - click to close. The cost is less than 300. You probably know that the value of a vehicle drops dramatically just after you buy it and it depreciates with each year.

This is calculated by taking the depreciation amount in year 1. Guide to Capital Adequacy Ratio Formula. Youll use the sum you derived above to reach this value.

4 15 and so on down the column to find the percentage of depreciation rate for each year. C Decrease each year d None of them. Use our depreciation calculator to estimate the depreciation of a vehicle at any point of its lifetime.

This has been a guide to Markup Percentage Formula. Section 179 depreciation. Find the depreciation expense by multiplying the depreciable cost in the first year by the depreciation rate.

Every year the water heater would lose 10 of 50 5 in its value. Also known as a Percentage Depreciation Calculator the Declining Balance Depreciation Calculator provides visability of a declining balance depreciation is where an asset loses value by an annual percentage. Of sub-section 1 of section 32 the percentage to be applied will be the percentage specified against sub-item 1 or 2 of item I as may.

It will calculate straight line or declining method depreciation. The basis for depreciation of MACRS property is the propertys cost or other basis multiplied by the percentage of businessinvestment use Quoted from pub 946. This depreciation calculator is for those that need to calculate a depreciation schedule for a depreciating asset such as an investment property.

Edmunds True Cost to Own TCO takes depreciation. The MACRS is set up to fully depreciate the asset. Here we discuss how to calculate Markup Percentage along with practical examples.

The asset is not part of a set costing more than 300. Expertly Manage the Largest Expenditure on the Balance Sheet with Efficiency Confidence. You may also look at the following articles to learn more Calculation of Markup Price.

Where A is the value of the car after n years D is the depreciation amount P is the purchase amount R is the percentage rate of depreciation per annum n is the number of years after the purchase. Click here to find the first 3 year depreciation estimate for any car. This car depreciation calculator is a handy tool that will help you estimate the value of your car once its been used.

Percentage Declining Balance Depreciation Calculator When an asset loses value by an annual percentage it is known as Declining Balance Depreciation. The equation mentioned above looks at the companys absolute dollar amount of gross profit. D P - A.

We also provide Markup Percentage calculator with downloadable excel template. According to straight line method of providing depreciation the depreciation a Remains constant b Increase each year. Depreciation rates as per income tax act for the financial years 2019-20 2020-21 are given below.

We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. For example if an asset is worth 10000 and it depreciates at 10 per annum at the end of the first year the depreciation amount is. Allows calculating APY of savings based on daily monthly quarterly semiannual and annual interest compounding corresponding to compounding once per day month quarter 6.

Find out how fast a car is losing value to help you determine optimal buy and sell moments. This value is known as the actual cash value of the appliance. There are 4 pre-conditions on the under-300 full claim allowance.

This calculator performs calculation of depreciation according to the IRS Internal Revenue Service that related to 4562 lines 19 and 20. It is the set percentage value or rate at which an item loses its value. You can use our depreciation calculator.

Generally a gross profit margins. Our property depreciation calculator helps to calculate depreciation of residential rental or nonresidential real property. Percentage of original value lost 1.

Still calculating the gross profit margin or rate as a percentage is often helpful. Free online Car Depreciation calculator. Calculate Property Depreciation With Property Depreciation Calculator.

The gross profit formula is calculated by subtracting the cost of goods sold from net sales and dividing the difference by net sales. Depreciation Percentage - The depreciation percentage in year 1. Ad Build Your Future With a Firm that has 85 Years of Investment Experience.

800 x 515 800 x 3333 percent. The values of these deductions are used to determine the assets recomputed basis at the time the taxpayer sells the asset. Use this online APY calculator to easily calculate the APY Annual Percentage Yield of a deposit based on the simple annual interest rate and the compounding period.

For example if you have an asset that has a total worth of 10000 and it has a depreciation of 10 per year then at the end of the first year the total worth of the asset is 9000. These formulas are used in the Depreciation Calculator described in Part 3 of this series. The final MACRS Depreciation Rates Table tells you the tax percentage you can itemize for your asset.

The average car depreciation rate is 14. Estmate future value of a car or similar vehicle. The depreciation rate tells you how much the appliance depreciate each year.

Its not much higher than 50 but over time or with a larger initial account balance this small amount ends up making a big difference. For example say you have a computer that falls into the MACRS 5-year table category and youve used that computer for 4 years the table tells you that you can deduct 1152 tax from that property. 32 percentage decrease in 4 years.

The schedules tell a taxpayer what percentage of an assets value may be deducted each year and the number of years in which the deductions may be taken. The asset is used for non-business purposes eg. The Car Depreciation Calculator uses the following formulae.

Straight Line Depreciation Formula And Calculation Excel Template

Car Depreciation Calculator

Double Declining Balance Depreciation Calculator

Depreciation Rate Formula Examples How To Calculate

Depreciation Rate Formula Examples How To Calculate

Depreciation Formula Calculate Depreciation Expense

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Asset Calculator

Depreciation Rate Formula Examples How To Calculate

Depreciation Calculation

Repeated Percentages Basic Depreciation Grade 5 Onmaths Gcse Maths Revision Youtube

Depreciation Formula Calculate Depreciation Expense

Straight Line Depreciation Calculator Double Entry Bookkeeping

Depreciation Calculator Property Car Nerd Counter

Depreciation By Fixed Percentage Youtube

Depreciation Calculator Definition Formula

Free Macrs Depreciation Calculator For Excel

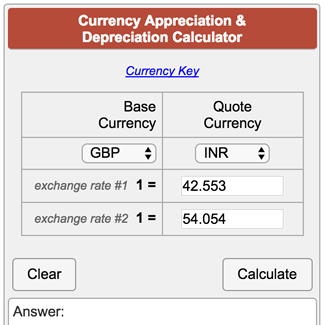

Currency Appreciation And Depreciation Calculator